Paid is your Full-Service, All-Inclusive, Complete Payroll Solution

We Are More than Just Software as a Service!

When it comes to managing payroll, juggling various tasks like calculating wages, deducting taxes, and staying compliant with regulations can be overwhelming. That's where our full-service payroll solution steps in to streamline your operations and provide peace of mind.

Ready to streamline your payroll process and take your business to the next level? Make the decision to choose our paid payroll solution today!

.png?width=100&height=100&name=Untitled%20design%20(3).png)

Why Choose Paid For your Payroll?

Real-time calculations and processing, position control with automated pay calculations, weighted average overtime calculations, and multiple payroll processing streamline payroll operations, ensuring accuracy and efficiency.

Certified payroll support, automated government form updates, state and local tax identification and validation, and vendor validation ensure compliance with tax laws and regulations, backed by expert assistance and automated updates.

AI-driven payroll alerts provide proactive notifications regarding payroll-related issues or potential errors, helping businesses stay informed and address issues promptly.

Audit and change history reporting offer transparency and accountability, allowing businesses to track payroll changes and maintain detailed records for auditing purposes.

Multi-EIN support and consolidated reporting, along with general ledger processing, streamline financial management by integrating payroll data with accounting systems and providing consolidated reports across multiple entities or locations.

Pay stub printing and distribution, 401(k)/retirement plan integration, earned-wage access, pay card integrations, and access to pay and total compensation statements empower employees with convenient access to their payroll information and benefits. Additionally, continuous W2 access ensures timely access to important tax documents.

Our Payroll Services Include

Effortless Wage Calculations

Say goodbye to manual calculations and errors. Our team handles all wage calculations accurately and efficiently, ensuring that your employees are paid correctly and on time.

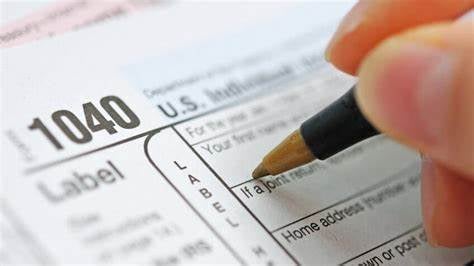

Tax Filing & Compliance Expertise

Navigating the complexities of tax deductions can be daunting. We handle all tax deductions, including federal, state, and local taxes, to ensure compliance and minimize the risk of costly errors.

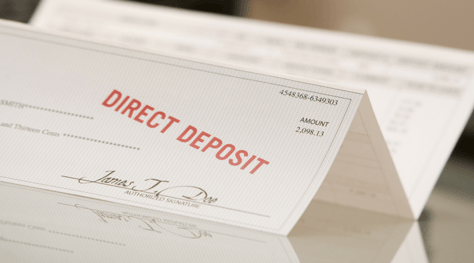

Timely Payment Processing

From issuing payments via direct deposit to printing and mailing checks, we handle payment processing with precision and speed, ensuring that your employees receive their wages promptly.

Seamless Tax Filings

Tax season doesn't have to be stressful. Our team takes care of all tax filings on your behalf, including quarterly and year-end filings, to keep your business compliant and avoid penalties.

Regulatory Compliance

Staying compliant with ever-changing regulations is crucial. Our experts stay up-to-date with the latest labor laws and regulations, ensuring that your payroll practices are in line with industry standards.

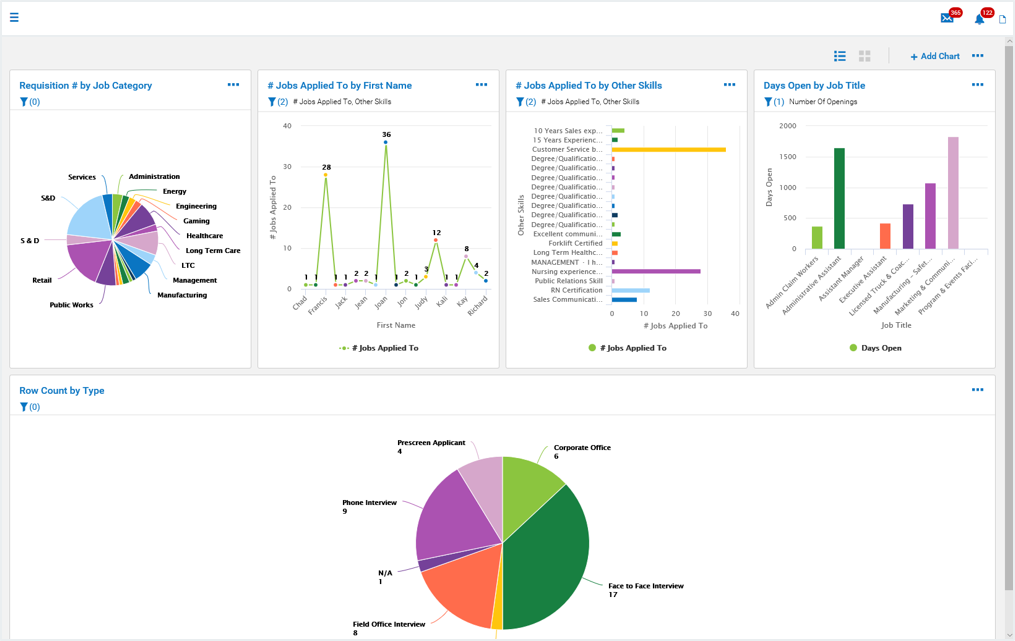

Customized Reporting

Gain insights into your payroll data with customized reports tailored to your specific needs. Whether you need detailed breakdowns of payroll expenses or summaries of employee earnings, our reporting capabilities provide valuable insights for informed decision-making.

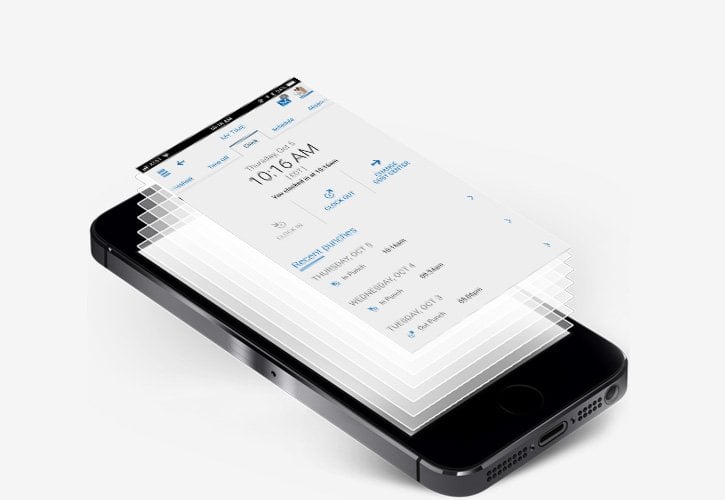

Employee Self-Service Portal

Empower your employees with access to their payroll information anytime, anywhere. Our self-service portal allows employees to view and print pay stubs, update personal information, and access tax documents with ease, reducing administrative tasks for your HR team.

Dedicated Support

Have questions or need assistance? Our dedicated support team is here to help. From onboarding assistance to ongoing support, we're committed to providing exceptional service and ensuring a smooth payroll experience for you and your employees.

of employees would consider leaving their job due to payroll-related issues, such as late payments or inaccuracies.

Discover Our Pre-Recorded Demos

Explore our solutions at your convenience with instant access to pre-recorded demos. Gain comprehensive insights, learn at your own pace, and make informed decisions without waiting for a scheduled demo.

of employees have experienced paycheck errors at least once during their employment.

of businesses report that outsourcing payroll services saves them time and resources.

of small businesses incur IRS penalties annually due to payroll tax errors or late filings.

of organizations face challenges in staying compliant with changing tax laws and regulations.

of employees prefer direct deposit over paper checks for receiving their salaries.

Learn More about what we offer with our Payroll.

-

Automated Payroll Processing

Transform your company’s payroll management by embracing automation for all calculations related to salaries, taxes, deductions, and benefits. This innovative approach not only minimizes the likelihood of human error but also significantly streamlines administrative tasks, freeing up valuable time. By integrating advanced automation tools, you can ensure accurate and timely payroll processing, providing peace of mind for both the finance team and your employees. This shift towards a more efficient payroll system allows your business to focus on growth and development, while also enhancing employee satisfaction through reliable and precise compensation management. Embrace the future of payroll with automation, and take the first step towards a more efficient, error-free financial management system.

-

Direct Deposit

Enable direct deposit for employees, allowing them to receive their salaries directly into their bank accounts. This eliminates the need for paper checks and reduces administrative overhead.

-

Tax Filing and Compliance

Ensure compliance with tax laws and regulations by automatically calculating and filing payroll taxes. This feature helps businesses avoid penalties and stay up-to-date with changing tax requirements.

-

Employee Self-Service Portal

Provide employees with access to an online portal where they can view their pay stubs, tax documents, and benefits information. This empowers employees to manage their payroll-related tasks independently.

-

Time and Attendance Tracking Integration

Integrate with time and attendance tracking systems to accurately record employee hours worked. This integration ensures that payroll calculations

-

Customizable Reporting

Generate customizable reports on payroll expenses, tax liabilities, employee earnings, and more. Customizable reporting allows businesses to gain insights into their payroll data and make informed decisions.

-

Employee Benefits Management

Manage employee benefits such as health insurance, retirement plans, and paid time off within the payroll system. This feature helps businesses track benefit eligibility, enrollment, and deductions accurately.

-

Multi-State Payroll Support

Cater to businesses operating in multiple states or countries by offering support for multi-state payroll processing. This feature ensures compliance with regional labor laws and tax regulations.

-

Mobile Accessibility

Provide mobile accessibility through a dedicated app or mobile-friendly website, allowing managers and employees to access payroll information on the go. Mobile accessibility enhances flexibility and convenience for users.

-

Employee Onboarding and Offboarding

Facilitate smooth onboarding and offboarding processes by managing payroll-related tasks such as setting up new employees, configuring payroll deductions, and processing final paychecks for departing employees.

-

Employee Reimbursement Management

Simplify the reimbursement process by allowing employees to submit expense reports electronically and reimbursing them through the payroll system. This feature streamlines expense tracking and ensures timely reimbursements.

-

Comprehensive Data Security

Implement robust security measures, such as encryption, access controls, and regular audits, to safeguard sensitive payroll data against unauthorized access, data breaches, or identity theft.

-

Third-Party Payments Integration

Integrate with third-party service providers, such as insurance companies or retirement plan administrators, to facilitate direct payments for employee benefits and deductions, reducing manual processing efforts.

-

Compliance Updates and Alerts

Provide timely updates and alerts regarding changes in tax laws, labor regulations, or compliance requirements that may impact payroll processing, helping businesses stay informed and avoid compliance-related risks.

-

Payroll Cost Allocation

Enable businesses to allocate payroll costs to different departments, projects, or cost centers accurately, providing insights into labor expenses and facilitating budgeting and financial analysis.

-

Customizable Workflows and Approval Processes

Configure customizable workflows and approval processes for payroll tasks, such as salary adjustments or bonus payments, ensuring proper authorization and adherence to company policies.

-

Dedicated Support

Have questions or need assistance? Our dedicated support team is here to help. From onboarding assistance to ongoing support, we're committed to providing exceptional service and ensuring a smooth payroll experience for you and your employees.

3 min read

Unified Payroll and Accounting for Growing Companies

Matt Edman: Oct 2, 2025

3 min read

4 Ways to Strengthen HR and Payroll Collaboration

Matt Edman: Jan 9, 2025